If you’re chasing carnivals, fetes, and frequent flyer perks, the Max Rewards app might just become your Carnival travel sidekick. Max Rewards is one of the most powerful credit card management tools out there. Whether you’re planning your next Caribbean Carnival trip or just trying to stay on top of your offers and expenses, the Max Rewards app helps you make every swipe count. From unexpected cashback to unlocking hidden card offers, it’s a low-effort way to reduce your out-of-pocket costs.

As someone who’s traveled to Carnival after Carnival using points and miles, trust me—missing out on available credit card offers is like skipping a cool down after Trinidad Carnival. Don’t do it. Here’s a full Max Rewards app review tied into real Carnival life, how the app helped me get 10% back unexpectedly, and why it should be part of your travel rewards game.

What is the Max Rewards App?

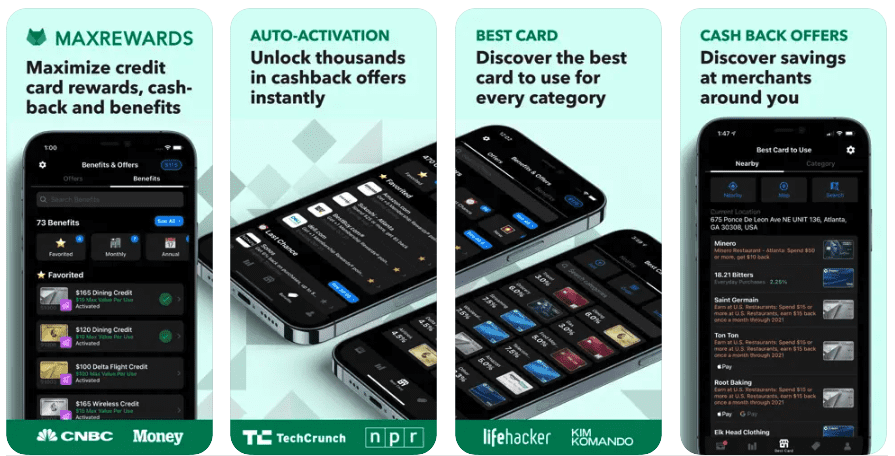

Max Rewards is a mobile app and browser extension that syncs with your credit cards to show you all your rewards, spending categories, sign-up bonus progress, and hidden offers. Think of it as a backstage pass to your wallet.

Most Carnival chasers use multiple credit cards—AMEX for flights, Chase for hotels, Citi for groceries—and things get chaotic. Max Rewards takes that chaos and turns it into clear, actionable insights. It shows you where you’re earning, what bonuses you’re missing, and which card to use for any given purchase.

Even when you’re just out shopping for last-minute Carnival essentials—think boots, accessories, or J’ouvert supplies—you can use the Max Rewards app to instantly figure out which card gives you the best return. No more guessing if it’s 2x or 5x back. It tells you, right then and there.

For example, I once used my Blue Business Plus card without knowing there was a 10% cashback offer loaded on it. Surprise savings. That’s the kind of thing Max Rewards prevents you from missing—because it activates those offers for you (with the Gold feature, but more on that later).

Why Credit Card Management Matters for Carnival Travelers

Carnival planning is exciting—but it can also get expensive. Flights, accommodations, costume deposits, fete tickets, and local transportation quickly stack up. When you’re juggling all those charges across multiple credit cards, it’s easy to lose track of spending, miss out on points, or worse—forget to hit a minimum spend for a welcome bonus.

That’s exactly where Max Rewards steps in. It helped me stay on track when I was managing multiple sign-up bonuses (SUBs) at once. I was chasing AMEX Gold, Delta SkyMiles Platinum, and a Capital One Savor offers simultaneously. That’s a lot of tracking. The app kept my deadlines straight and showed me how much more I needed to spend to unlock each bonus.

Without that guidance, I might have missed a key SUB—potentially losing out on points to book flights or hotels for my next Carnival trip. Max Rewards helped me make it all work, down to the dollar.

Travel credit cards can be a key tool for carnival chasers. To learn more, click here.

Max Rewards App Features That Make Travel Easier

The standard Max Rewards app has a suite of features perfect for both daily budgeting and big-picture travel planning:

- Rewards Dashboard: Instead of juggling multiple apps and logins to check how many points you’ve earned with each card, the Rewards Dashboard consolidates all your balances in one place. Whether you’re earning AMEX Membership Rewards, Chase Ultimate Rewards, or Citi ThankYou Points, it provides a snapshot of your total travel potential. No more guesswork—just clarity.

- Spending Category Breakdown: Understanding where your money goes is the first step to optimizing your rewards. This feature categorizes your spending—groceries, dining, travel, and more—so you can match your purchases to the best card. If your travel card earns 3x on dining, you’ll know to use that card when you’re wining and dining in Port of Spain.

- Chase 5/24 Tracker: One of the most important tools for credit card enthusiasts. Chase has an unofficial rule of denying new applicants who’ve opened five or more personal credit cards within the last 24 months. This rule is known as Chase 5/24—and it’s a dealbreaker for anyone trying to snag a new Chase card. Max Rewards keeps a running total of your open cards so you know exactly when you’re eligible again. I relied on this tracker to guide my card strategy and make sure I was staying clear of the limit before applying again.

- Sign-on Bonus Tracker: Most premium travel cards offer hefty welcome bonuses—sometimes 60,000 points or more. But you’ve got to meet a minimum spend within a set time. This tracker keeps tabs on how close you are to unlocking that bonus, which is critical when timing your spending around Carnival travel purchases. I had three SUBs going at once—and Max Rewards helped me time them perfectly.

- Utilization Tracker: Keeping your credit utilization low is essential for a healthy credit score. This feature monitors your balances across all cards and alerts you when you’re getting close to thresholds that might hurt your score. Staying under 30% utilization is golden—and this tracker helps you stay there.

- Next Card Recommendation: Based on your profile and current cards, the app uses algorithms to recommend which credit card to open next. Whether you want more travel points, cash back, or a card with no foreign transaction fees, Max Rewards helps you build a well-rounded wallet aligned with your Carnival travel goals.

Planning for Saint Lucia Carnival or Trinidad Carnival? This app tells you how many more points you need for that roundtrip ticket—or whether you’ve already got enough to book.

How Max Rewards Gold Supercharges Your Savings

Max Rewards Gold is the premium version of the app, and it’s where the real magic happens. With Gold, the app can automatically:

- Activate hidden offers on your American Express and Chase cards

- Track spend across multiple cards in real time

- Update benefits without manual input

Before I used Gold, I had no idea my Blue Business Plus was offering 10% back on a purchase. I bought something I was going to buy anyway—and only realized afterward that Max Rewards had auto-activated the deal. That surprise $10 on $100 back? Yes, please.

If you’re a Carnival traveler, these small wins add up. From outfits to flights to Airbnb stays, there are tons of ways you’re already spending—and Gold makes sure you’re rewarded for all of it.

Max Rewards Browser Extension

Don’t sleep on the browser extension. It’s especially useful when booking travel, because:

- It reminds you of offers while shopping

- Suggests the best card to use at checkout

- Keeps travel booking benefits top-of-mind

I used it while booking my hotel for Miami Carnival, and it told me my Marriott Bonvoy Business card had a 5X offer at participating properties. If you’re trying to squeeze every point out of a trip, this tool is essential.

Max Rewards and Caribbean Carnival Travel: A Perfect Match

Let’s talk real. Carnival isn’t cheap. Flights, costumes, accommodations, fete tickets—it adds up fast. But if you’re strategic with your spending, the Max Rewards app can help you:

- Meet minimum spend to earn travel card welcome bonuses

- Track and stack cashback offers while buying Carnival essentials

- Stay under budget with spending insights

- Redeem points at the right time for max value

When you’re using the right card at the right time, you get more from every dollar. And when you’re doing that over multiple trips? That’s how I funded my flight to Grenada for Spice Mas, entirely on points.

The Real Pros and Cons of the Max Rewards App

No app is perfect, and Max Rewards is no exception—but the good far outweighs the not-so-great. Here’s a deeper look into what makes the app shine, and where it might fall short for some users. If you’re serious about optimizing every dollar for Caribbean Carnival travel, this breakdown will help you decide if Max Rewards deserves a permanent spot in your digital toolkit.

Pros of the Max Rewards App

User-Friendly Interface That Makes Sense: Even if you’re not a points and miles expert, Max Rewards is designed to be easy to use. The app is clean, well-organized, and makes it simple to track rewards, bonuses, and offers at a glance. For busy Carnival chasers, this is a game-changer.

Deep Integration With Major Card Issuers: The app supports a wide range of major banks, including AMEX, Chase, Citi, and Capital One. That means you can manage multiple cards in one place without hopping between apps. It’s like having a travel rewards hub in your pocket.

Automatic Offer Activation (Gold Feature): With Gold, Max Rewards activates offers for you—no more logging into AMEX or Chase to manually click “Add Offer.” This alone can save you money without you even realizing it, especially when you’re in the middle of Carnival season and distracted by all the fun.

Sign-On Bonus and Utilization Trackers: Keeping an eye on your minimum spend requirements and credit utilization is critical if you’re playing the credit card rewards game. These trackers keep you organized and help protect your credit score while maximizing your returns.

Chase 5/24 Tracker: If you’ve ever been unsure whether you’re eligible for a Chase card, this feature takes the guesswork out. It tells you exactly where you stand with the infamous 5/24 rule, helping you time your applications wisely.

Eliminates the Spreadsheet Overwhelm: Let’s be real—manually tracking rewards in Excel is for the birds. Max Rewards automates that whole process, freeing you up to focus on booking your next Carnival adventure.

Cons of the Max Rewards App

Gold Subscription Is a Must for Serious Users: While there is a free version, the most useful features—like automatic offer activation and real-time updates—are locked behind the Gold membership. If you want to maximize your rewards, the subscription is essentially a requirement.

Not Every Bank Is Covered: Max Rewards supports the majority of big-name issuers, but if you bank with a small regional credit union or a niche rewards card, you may not be able to sync it with the app. This is rarely an issue, but worth noting.

Syncing Can Occasionally Lag: Like any app that connects to third-party financial data, there can be brief sync delays or the occasional hiccup. It’s usually resolved with a refresh, but if you’re super detail-oriented, this might feel like a minor speed bump.

Some Features Take Time to Learn: While the app is intuitive, maximizing all the features does come with a slight learning curve—especially if you’re new to the credit card rewards space. Thankfully, they have tutorials, and the Discord community is a great help.

Tips for Maximizing Travel Rewards with Max Rewards

If you’re looking to stretch your Carnival budget even further, try these travel-tested tips:

- Stack Your Rewards: Use the Max Rewards app to identify category bonuses, then layer in shopping portal bonuses for even more back.

- Set a Budget Based on Your Sign-On Bonuses: If you need to spend $4,000 in three months to get that 60,000-point bonus, time it around when you’ll be buying flights and fetes.

- Plan Around Transfer Partners: Use Max Rewards to see how many points you’ve earned, then transfer to airlines like JetBlue or American for better redemption value.

- Keep Track of Fete Expenses: Use spending breakdowns to see how much you’re dropping on tickets, drinks, and outfits—then use that data to plan smarter for your next Carnival.

These small changes can add up to free flights, hotel nights, or extra cashback to put toward your next wine on the road.

A constantly evolving app that listens to others

One of the best things about Max Rewards? It’s not static. The development team is constantly refining features, fixing bugs, and adding new tools based on user feedback. You can even submit your own feature requests directly in the app. If there’s something you’d love to see—whether it’s Carnival-specific tracking or more detailed cashback alerts—they’re open to ideas.

Even better? There’s an active Discord community where Max Rewards users share tips, wins, bugs, and app requests. It’s like a digital Carnival of reward strategists. Whether you’re a casual user or an obsessive points optimizer, you’ll find your tribe there.

Max Rewards App: Frequently Asked Questions

Is Max Rewards free? How do they make money?

Yes! Max Rewards has a free version that gives you a good peek into your credit card rewards and offers. But if you really want to unlock its full power—like automatic offer activation—you’ll want to upgrade to Gold. That’s where the company makes its money, through Gold subscriptions. Personally, Gold paid for itself within a few weeks for me.

Is Max Rewards safe to use?

I get it—security is everything when you’re linking financial accounts. Max Rewards takes security seriously. They use strong encryption, separate storage for credentials, and only access your data with secure tokens. I’ve never had an issue, and I’m very picky about who I trust with my accounts.

What banks and cards does Max Rewards support?

They support all the big names: Chase, Amex, Citi, Capital One, Discover, and more. I use cards from multiple issuers and everything syncs seamlessly. Unless you’re using a super niche bank, you’re probably covered.

My deals didn’t activate. What now?

Been there. If you’re a Gold member and don’t see your deals activating, pull down on the Wallet tab to refresh your accounts. That usually solves it. And if not, Max Rewards’ support team is responsive—they helped me out in the past without any hassle.

Can I edit or customize my rewards categories?

Yup! If a category isn’t showing the right multiplier or you want to adjust something manually, you can do that in the Rewards tab. Just tap the star, then the pencil icon, and select what you want to tweak. It’s great if you’re someone who switches up spending habits throughout the year (hello, Carnival season).

How to Get a Free Month of Max Rewards Gold

If you’re ready to start saving smarter, I’ve got you. Use my referral link to sign up and get a free month of Max Rewards Gold: maxrewards.app.link/traceyl83

Try it out during your next Carnival planning sprint. You’ll be amazed how many hidden offers you’ve missed—and how much you can save with almost no effort.

Travel Smarter, Not Harder with Max Rewards

Carnival is not just a party. It’s an investment in culture, joy, and liberation—and for many of us, it’s a lifestyle. When you commit to the road, your credit card strategy should be just as strong as your costume game.

Max Rewards doesn’t just help you save money. It helps you think smarter about the money you’re already spending. It eliminates guesswork, maximizes every swipe, and gives you the tools to stretch your budget across multiple Carnivals.

So whether you’re heading to Trinidad, Saint Lucia, Grenada, or Miami—make Max Rewards part of your masquerader toolkit. Because the more you optimize, the more you wine.